Hard Money Georgia for Beginners

4 Easy Facts About Hard Money Georgia Explained

Table of ContentsGet This Report about Hard Money GeorgiaGetting My Hard Money Georgia To Work3 Easy Facts About Hard Money Georgia DescribedThe Hard Money Georgia PDFs

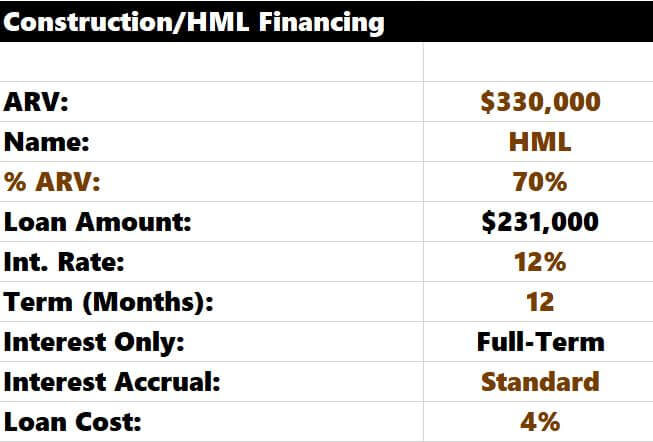

The maximum appropriate LTV for a tough cash funding is usually 65% to 75%. That's just how much of the residential or commercial property's price the lending institution will want to cover. For example, on a $200,000 house, the optimum a hard money lender would want to provide you is $150,000. To purchase the residential or commercial property, you'll have to develop a down payment huge enough to cover the remainder of the acquisition rate.

By comparison, interest rates on tough money loans start at 6. Tough money lenders frequently charge points on your funding, occasionally referred to as source costs.

Factors are typically 2% to 3% of the lending amount. 3 factors on a $200,000 finance would certainly be 3%, or $6,000. hard money georgia. You may need to pay more points if your car loan has a higher LTV or if there are multiple brokers involved in the transaction. Some loan providers charge just points and no other fees, others have added prices such as underwriting charges.

Hard Money Georgia - The Facts

You can anticipate to pay anywhere from $500 to $2,500 in underwriting costs. Some hard money lenders likewise charge early repayment fines, as they make their cash off the interest charges you pay them. That indicates if you settle the finance early, you may have to pay an extra fee, including to the loan's price.

This means you're most likely to be used financing than if you looked for a typical home mortgage with a suspicious or thin credit rating background. If you require money promptly for renovations to turn a residence commercial, a difficult money finance can give you the cash you require without the problem and also documentation of a typical home mortgage.

It's an approach investors make use of to acquire financial investments such as rental properties without using a great deal of their own possessions, and also difficult cash can be helpful in these scenarios. Although hard money finances can be useful genuine estate capitalists, they should be utilized with care particularly if you're a beginner to actual estate investing.

If you fail on your car loan payments with a tough cash lender, the effects can be severe. Some loans are directly guaranteed so it can harm your credit.

The smart Trick of Hard Money Georgia That Nobody is Talking About

To find visit here a reputable explanation loan provider, speak to relied on realty agents or home loan brokers. They might have the ability to refer you to lenders they've worked with in the past. Difficult cash lending institutions also typically participate in investor meetings to ensure that can be a great location to attach with lenders near you.

Equity is the value of the building minus what you still owe on the home mortgage. Like hard cash lendings, home equity car loans are secured debt, which implies your home works as collateral. The underwriting for residence equity finances also takes your debt history and earnings right into account so they tend to have lower passion prices as well as longer repayment periods.

When it involves funding their following bargain, investor and also entrepreneurs are privy to numerous providing alternatives virtually created realty. Each features specific needs to gain access to, and also if utilized effectively, can be of massive advantage to capitalists. One of these borrowing types is tough money financing.

It can additionally be called an asset-based funding or a STABBL loan (short-term asset-backed bridge lending) or a bridge car loan. These are obtained from its characteristic short-term nature and the need for tangible, physical security, generally in the kind of actual estate property.

The 9-Minute Rule for Hard Money Georgia

In the exact same blood vessel, the non-conforming nature pays for the loan providers a chance to pick their very own particular needs. Therefore, demands might vary significantly from lending institution to lender. If you are seeking a loan for the very first time, the authorization procedure could be fairly rigorous and also you might be required to offer added details.

This is why they are generally accessed by property business owners that would generally require rapid financing in order to not lose out on hot opportunities. Furthermore, the loan provider primarily thinks about the worth of the possession or residential or commercial property to be bought instead of the customer's personal financing history such as credit history or income.

A traditional or small business loan may take up to 45 days to shut while a tough cash funding can be closed in 7 to 10 days, in some cases sooner. The Read Full Article comfort as well as speed that hard cash financings use stay a major driving pressure for why genuine estate capitalists pick to use them.